Stability Pool and Liquidations

What is the Stability Pool?

The Stability Pool is the first line of defense in maintaining system solvency. It achieves that by acting as the source of liquidity to repay debt from liquidated positions—ensuring that the total vUSD supply always remains backed.

When any position is liquidated, an amount of vUSD corresponding to the remaining debt of the position is burned from the Stability Pool’s balance to repay its debt. In exchange, the entire collateral from the position is transferred to the Stability Pool.

The Stability Pool is funded by users transferring vUSD into it (called Stability Providers). Over time Stability Providers lose a pro-rata share of their vUSD deposits, while gaining a pro-rata share of the liquidated collateral. However, because positions are likely to be liquidated at just below 110% collateral ratios, it is expected that Stability Providers will receive a greater dollar-value of collateral relative to the debt they pay off.

Why should I deposit vUSD to the Stability Pool?

Stability Providers will make liquidation gains (see below) and receive early adopter rewards in form of VIRTUE tokens.

What are liquidations?

To ensure that the entire stablecoin supply remains fully backed by collateral, positions that fall under the minimum collateral ratio of 110% will be closed (liquidated).

The debt of the position is canceled and absorbed by the Stability Pool and its collateral distributed among Stability Providers.

The owner of the position still keeps the full amount of vUSD borrowed but loses ~10% value overall hence it is critical to always keep the ratio above 110%, ideally above 150%.

Who can liquidate positions?

Anybody can liquidate a position as soon as it drops below the Minimum Collateral Ratio of 110%. The initiator receives a gas compensation (10 vUSD + 0.5% of the position's collateral) as reward for this service.

How am I compensated for liquidating a position?

The liquidation of positions is connected with certain gas costs which the initiator has to cover. The cost per position was reduced by implementing batch liquidations of up to 160 - 185 positions but with the aim of ensuring that liquidations remain profitable even in times of soaring gas prices the protocol offers a gas compensation given by the following formula:

gas compensation = 10 vUSD + 0.5% of position's collateral (wSMR)

The 10 vUSD is funded by a Liquidation Reserve while the variable 0.5% part (in wSMR) comes from the liquidated collateral, slightly reducing the liquidation gain for Stability Providers.

How do I benefit as a Stability Provider from liquidations?

As liquidations happen just below a collateral ratio of 110%, you will most likely experience a net gain whenever a position is liquidated.

Let’s say there is a total of 1,000,000 vUSD in the Stability Pool and your deposit is 100,000 vUSD.

Now, a position with debt of 200,000 vUSD and collateral of 174,400 wSMRis liquidated at an wSMR price of $1,25, and thus at a collateral ratio of 109% (= 100% * (174,400 *1,25) / 200,000). Given that your pool share is 10%, your deposit will go down by 10% of the liquidated debt (20,000 vUSD), i.e. from 100,000 to 80,000 vUSD. In return, you will gain 10% of the liquidated collateral, i.e.17,440 wSMR, which is currently worth $21,800. Your net gain from the liquidation is $1,800.

Note that depositors can immediately withdraw the collateral received from liquidations and sell it to reduce their exposure to wSMR, if the USD value of wSMR is expected to decrease.

How do I benefit as a Stability Provider from early adopter rewards?

First you need to open a position, borrow vUSD, and deposit it to the Stability Pool. After making your deposit, you will start accumulating a reward (in VIRTUE) proportional to the size of your deposit on a continuous basis. The reward is calculated according to the rewards schedule. Rewards will be the highest for early adopters of the system. Full tokenomics paper will be released in due course.

At any point in time, you can withdraw your pending rewards to your ShimmerEVM address.

Can I withdraw my deposit whenever I want?

As a general rule, you can withdraw the deposit made to the Stability Pool at any time. There is no minimum lockup duration. However, withdrawals are temporarily suspended whenever there are liquidatable positions with a collateral ratio below 110% that have not been liquidated yet.

What oracle are you using to determine the price of wSMR?

The protocol uses Pyth’s wSMR:USD price feed, falling back to the Redstone wSMR:USD oracle under the following (extreme) conditions:

- Pyth’s price has not been updated for more than

4 hours - Pyth response call reverts, returns an invalid price or an invalid timestamp

- The price change between two consecutive Pyth price updates is

>50%.

Can I lose money by depositing funds to the Stability Pool?

While liquidations will occur at a collateral ratio well above 100% most of the time, it is theoretically possible that a position gets liquidated below 100% in a flash crash or due to an oracle failure. In such a case, you may experience a loss since the collateral gain will be smaller than the reduction of your deposit.

If vUSD is trading above $1, liquidations may become unprofitable for Stability Providers even at collateral ratios higher than 100%. However, this loss is hypothetical since vUSD is expected to return to the peg, so the “loss” only materializes if you had withdrawn your deposit and sold the vUSD at a price above $1.

Please note that although the system is diligently audited, a hack or a bug that results in losses for the users can never be fully excluded.

What happens if the Stability Pool is empty when liquidations occur?

If the Stability Pool is empty, the system uses a secondary liquidation mechanism called redistribution. In such a case, the system redistributes the debt and collateral from liquidated positions to all other existing positions. The redistribution of debt and collateral is done in proportion to the recipient position's collateral amount.

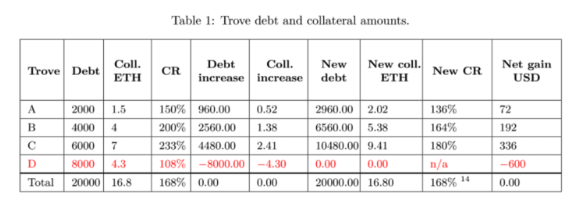

Here's an example: